Read time: 8 mins

Hey, digital ads professionals! What a month, huh? We’ve been busy with Benchmarks launch (did you read it? it’s really good, you should read it), and in the midst of it all came not one but two bombshell stories about ad giant / everything company Google.

First, they lost yet another antitrust suit, and second, they announced an end to the years-long experiment with cookie deprecation in Chrome. Here’s a behind-the-scenes peek at my immediate reaction:

These are both legitimately big-deal stories, so we’re going to talk about what they are, why they matter, and what we think nonprofits should do!

Here’s the tl;dr:

- Google’s announcement doesn’t change the fundamentals: the industry has moved on from third-party cookies. Nonprofits should continue to invest in cookie-agnostic tools for measurement and attribution (such as Yahoo’s ConnectID, LiveRamp’s RampID, Viant’s HouseholdID, and others) – just with an awareness that Google’s Privacy Sandbox won’t be among them.

- Google might have to sell off big parts of the company – and that’s probably a good thing! Nonprofits should prepare for a less monopolistic ad industry over the long term, and can take advantage of this shift with channel diversification and vendor testing.

Alright, you ready for the longer/nerdier version? Let’s start with cookies.

[this is where we’d put a punny subheader about cookies crumbling if we had even one joke left to make but the truth is we just don’t 😫 as consolation, here’s a cookie]

A quick recap of this entirely overbaked (oh darn, I guess we did have one joke left in the cookie jar) saga:

Third-party cookies are a technology used to build audiences and report on the effectiveness of ads – they’re primarily useful in contexts where people are passively interacting with advertising, such as viewing a banner ad or a short video on a desktop or mobile device. They are very outdated as a piece of technology (they debuted when yours truly was a literal toddler, cronching on my Dunkaroos and Chips Ahoy!): they’re not particularly secure, and they don’t work in many of the environments where ads measurement is most important (such TVs or in-app ads). For all these reasons, the industry’s been making a long-term shift to replace them with other tools for measurement and audience-building.

The transition was sped up by Google’s announcement in 2020 that they would end support for 3P cookies in Chrome… but we very deliberately say “sped up,” not “caused” or even “initiated.”

That’s because Safari and Firefox (the next-biggest browsers, accounting for ⅓ of US browser traffic) had already phased out 3P cookies. Additionally, an increasing share of advertising had already shifted to contexts where 3P cookies are largely irrelevant (such as Connected TV and in-app) – which meant that savvy advertisers had already begun adoption of cookieless or cookie-agnostic solutions for reporting and audience building.

This transition wasn’t isolated to ads, either: a good example of the broader shift is enhanced conversions in GA4: that’s a holistic measurement tool that’s quietly transitioned away from any need for 3P cookies by replacing them with reporting based on user-provided data like email address.

(For more on this topic, check out our prior posts here and here, as well as a webinar!)

That point about a less cookie-dependent ads ecosystem is really important, so we’re going to repeat it. Third-party cookies were/are primarily useful for traditional display and video ads: they are far less essential for click-heavy channels like social, search, and multi-channel formats like Performance Max, and they’re entirely useless for ads that occur outside of a traditional browser (like Connected TV or audio).

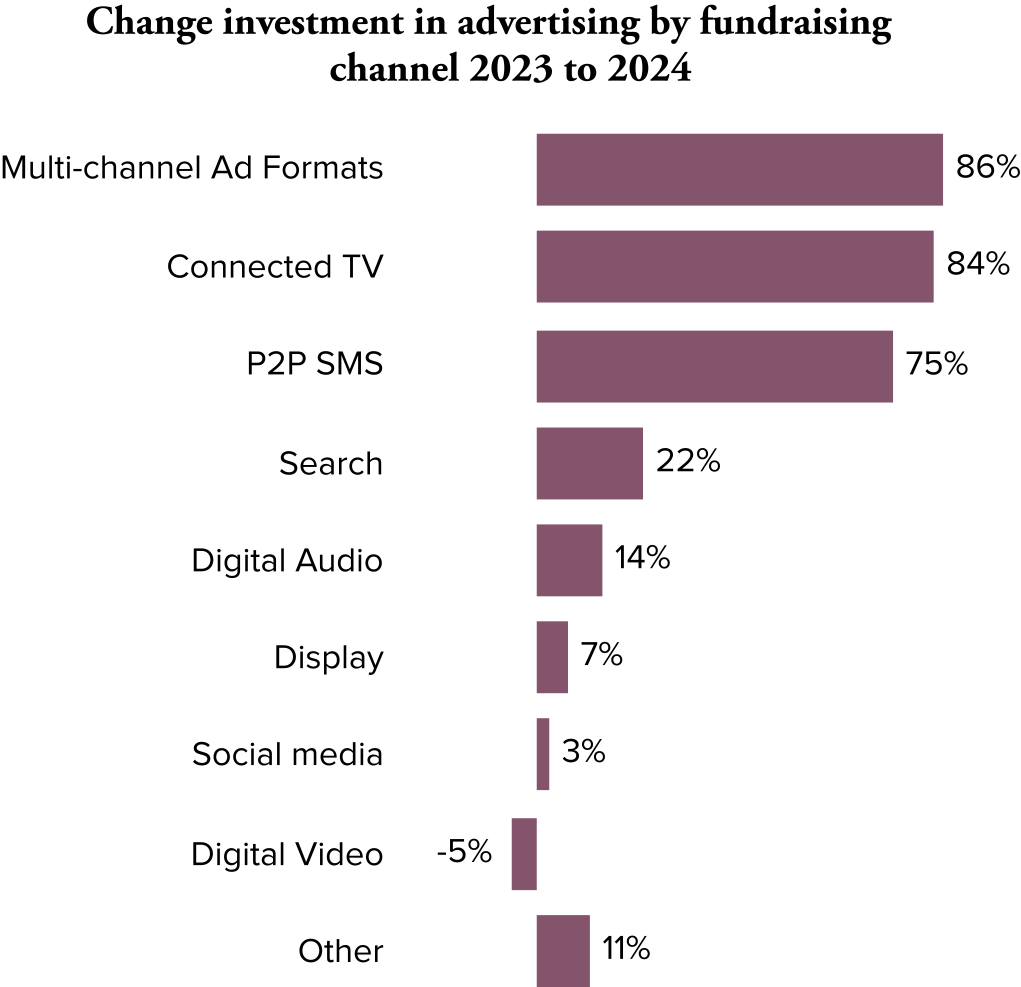

This matters because the less-cookie-ish channels are the biggest and fastest-growing parts of the industry. Don’t take our word for it – here’s Benchmarks:

The fastest-growing channels for nonprofit fundraising in 2024 were multi-channel formats like Performance Max, Connected TV, and peer-to-peer SMS – none of which rely primarily on 3P cookies.

The rise in CTV advertising is especially relevant for this conversation: we can all-but-guarantee that every organization running fundraising ads on CTV is doing it with some kind of cookieless reporting and audience-building solution – and we’d bet good money that many of those organizations are using those same cookieless solutions to enhance their display and video campaigns.

That’s why Google’s announcement has felt like such a dud across the industry: sure, advertisers can use 3P cookies in Chrome moving forward – but we don’t really need to, given the bounty of alternatives. If anything, the most notable subplot is that Google’s giving up on their preferred cookie replacement, Google Privacy Sandbox… clearing the way for other solutions like UUID and RampID to emerge as the industry standard.

The best path for nonprofits is the same it’s been for a while: adopt cookieless solutions for measurement and audience-building, and orient your web tactics and media investments toward a more holistic and multi-channel approach. For more details on those recommendations (including some more detail on ads-specific cookieless reporting!), check out our previous post on this topic, as well as the recording of our full webinar.

By the way, why did Google make this announcement about Chrome and cookies now? This is speculative, but it’s notable that the announcement coincided with a ruling that may eventually force them to sell Chrome – vastly reducing their incentives to develop that product.

… which brings us to the second big piece of news: let’s talk about anti-trust.

Anti-trust and the future of ads

You don’t really need to understand the specifics of the government’s lawsuits against Google to understand the reason for them: Google is clearly, obviously, no-shit-Sherlockly too powerful in the ads industry. In fact, that’s why you’re reading this post right now – precisely because this one tech giant is so powerful that any change to their company structure threatens to destabilize your ads program. It’s not too surprising that Google lost both suits, given the obviousness of this problem!

As of right now, the big question is: what will the courts force Google to do in order to fix this situation? There are a few possibilities, including creation of more open tools (like a live API of search traffic) and even a forced sale of certain entities (most notably Chrome) – and it’s notable that the big AI companies are openly salivating at all prospects. Nothing will be quick: we should expect months to years before everything is settled. But broadly, one of two things will happen:

- The remedies will succeed in creating a more open and competitive ads industry;

- The remedies will be insufficient to challenge Google’s dominance.

Uncertainty is scary, but trust when we say: door #1 would be unambiguously better for everyone, especially advertisers and including nonprofits.

Everyone suffers when a single company has a stranglehold on an industry. Want an example? Look to Meta.

Every nonprofit has a story about why Meta sucks. Their policies are opaque, nonsensical, and inconsistently applied. Their users hate them! And yet, despite it all, it can feel impossible to quit the platform (organically or for ads).

We saw a version of this in Benchmarks: social is the second-biggest channel for fundraising (accounting for 18% of spend), with the overwhelming majority of that spend going to Meta specifically. In 2024, budgets on that channel barely kept pace with inflation (+3% from the prior year) – and it’s almost surprising to see spend as high as it was, with return on investment ($0.48) falling below search, multi-channel formats, display, peer-to-peer SMS, and even audio.

We’ll never know if something similar would’ve happened to Google. You can certainly imagine it. But if these lawsuits make such an outcome less likely, that’s good for everyone.

In the meantime, how can nonprofits prepare? The same way they’ve responded to stagnation on Meta: with ambitious testing on new channels and vendors. Some specific ideas to try:

- Peer-to-peer SMS, which uses live text conversations with prospective donors: those ads saw a $62 cost per donation in our most recent Benchmarks.

- Connected TV (the second-fastest-growing fundraising channel in Benchmarks): it’s TV inventory bought programmatically, allowing you to leverage the powerful targeting capabilities of a vendor like Yahoo, MNTN, or Viant to access inventory on Roku, Hulu, and others.

- Smaller organizations with lower brand recognition might also experiment with awareness campaigns (using CTV alongside display, programmatic video, and audio) to build name recognition and soften the ground for fundraising efforts.

If the government is successful in breaking up Google, the organizations that’re most comfortable running a nimble and diversified ads program will be in the best position to take advantage of a more open industry… and if Google maintains its death grip on segments of the industry, then the organizations who’ve invested in developing alternatives will have the best shot at finding pockets of growth.

In other words… it’s gonna be okay. We can’t always predict the future of these horrible tech giants, but you don’t need a crystal ball to run effective ads programs. An openness to testing and an investment in the tech fundamentals will take you a long way, and that’s going to stay true whatever happens to Google.

And that’s all, folks!

—

Sarah Coughlon is M+R’s Director of Advertising Technology. She lives in Chicago with her two goofy rescue dogs: when she’s not thinking about ads (or the dogs), you can usually find her biking around the lakefront, cooking an elaborate meal for her friends, or loudly evangelizing about women’s sports.