I love working with food banks! The impact of their work is so direct and so important (this is my plug to get involved with your local food bank if you aren’t already!). And, turns out, there’s a lot to learn from food banks when it comes to digital fundraising too!

This year, a record 27 regional food banks participated in M+R’s annual Benchmarks Study covering mostly digital fundraising, marketing, advertising, and advocacy metrics (and here’s another plug…if you haven’t dug into this year’s study, do it now!). Sometimes when we have a particularly robust cohort of participants in one category, we’re able to pull out their data to do an even more specific version of the study. This year for the first time, we’re sharing the Food Bank Edition of Benchmarks publicly!

Now — let’s get into one of my favorite topics — Food Bank fundraising data!

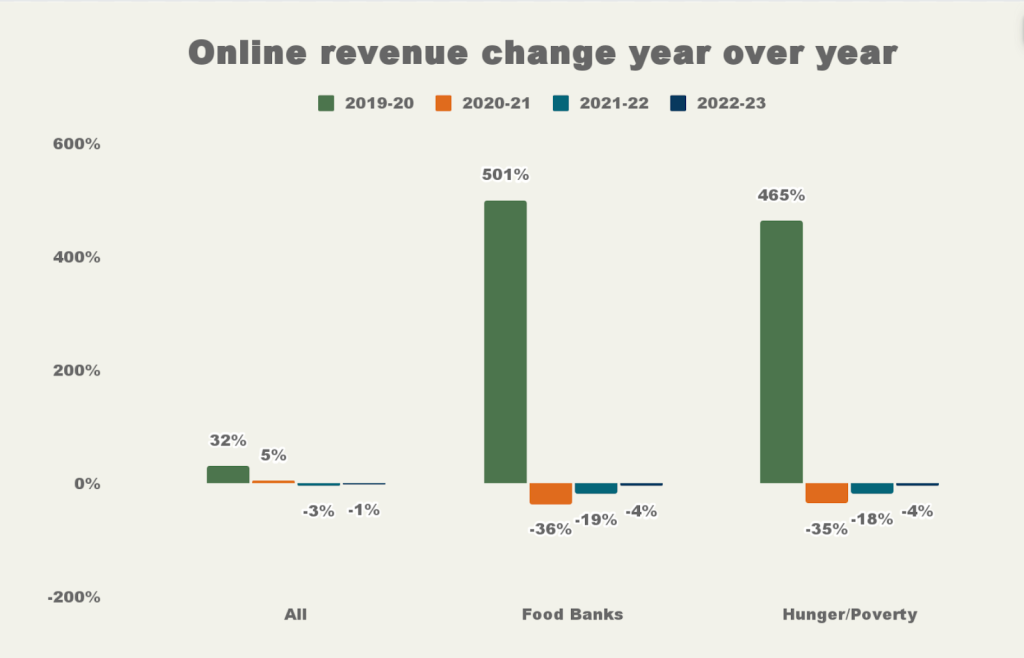

Perhaps more than any other sector, food bank’s fundraising programs were totally transformed by the COVID-19 pandemic. The average digital revenue growth for food banks from 2019 to 2020 was a mind-boggling 501% increase according to M+R’s Benchmarks!

Since that initial spike, we’ve seen revenue decline over the last few years, but the work of food banks has never been more vital — in fact, the rate of people experiencing hunger in the United States is at an all-time high. That, combined with the sunsetting of emergency government funding provided during the pandemic, means more people than ever are turning to their local food banks for help with food.

What’s more, the high cost of food that people are seeing at grocery stores also means it’s more expensive for food banks to purchase the food they distribute.

So, costs are higher, the need is higher, but the trend we are seeing is that food banks, like many other nonprofit organizations, are needing to work harder to keep up.

But, our 2024 Benchmarks study also shows some clear opportunities for food banks.

Here are a few of the toplines and takeaways we see. If you’re eager for the full food bank sector data you can download it here!

Top line takeaways

- Overall, food banks saw a 4% decrease in online revenue from 2022 to 2023, which was a larger decline than the industry as a whole at -1%. In context of the huge growth that food banks saw at the height of the pandemic, with 501% increase in digital revenue from 2019–2020, this 4% decline represents a leveling off and return to what we think is a “new normal” for the sector.

- The last two months of the year are HUGE for digital fundraising — and that’s especially true for food banks, with 21% of digital revenue coming in November and 36% in December. Part of this revenue can be attributed to Giving Tuesday and the end-of-year deadline fundraising push, just like so many other nonprofits. For food banks, those key moments are supplemented by robust fundraising around Thanksgiving.

- Monthly giving is becoming an increasingly important part of online giving strategy for the industry as a whole, but it’s making up an even larger part of food banks’ digital revenue at 36% in 2023, above the overall Benchmark of 31%.

- Email revenue remained mostly steady for food banks, with a 1% increase in email revenue while the industry overall saw a 7% decline. There are a few factors that contributed to this:

- Food banks are sending more emails compared to prior years, and diversifying the messaging types with many food banks seeing significant increases in engagement and advocacy messaging. That being said, food banks were sending fewer email messages than the overall Benchmark with 40 messages per subscriber in the year. This tells us that a lot of food banks are putting in the work to grow their email program, and there continues to be room for growth!

- While food banks saw a year-over-year decline, the email fundraising response rate is still well above the overall industry benchmark at 0.13%. The increased volume of email helped keep that revenue steady.

- Food banks are investing less in digital ads than the industry as a whole but seeing better returns on the investment with ROAS (return on ads spend) well above the overall benchmarks for Search, Display, and Meta and a lower CPD (cost per donation) on those platforms as well.

- But, like many other groups, returns have been declining on Meta, and as a result many food banks are shifting spend to other channels. We see investments increasing in Search and Display as well as diversifying into channels like audio.

Our recommendations

Food banks should be focusing on a few things to keep bolstering donor retention and maintain growth in digital channels:

Embrace advocacy and engagement messaging

In 2023, we saw a lot more food banks sending engagement messages and encouraging their digital subscribers to take action to end hunger in new ways, like reaching out to lawmakers. Advocacy and engagement messages overall have higher click-through and response rates than fundraising messages, which is one of the reasons a robust advocacy program can help boost supporter engagement and loyalty.

Throughout audience and message research, we have also found that food banks are trusted messengers in their communities. As we’ve said before, advocacy is a must for long-term impact. M+R is currently working with food banks planning Get Out the Vote efforts in their communities as well as digital activations around hunger-fighting policies.

If your food bank is ready to get into the advocacy space, Hunger Action Month in September is a great time to start introducing or increasing this type of communication with your list! (And if you’re looking for a partner to help with advocacy or election strategy please get in touch, we’d love to help!)

Diversify your channels

Continue to grow investment on ads and try out new channels. Many food banks are seeing success sizing out their existing social advertising content to programmatic display. While most of the results from display will not show up in CRM data, these ads can drive potential donors towards your search program and the homepage, creating incremental demand and conversions.

As many advertisers have continued to struggle with declining Meta performance outside of peak moments for their program, they are experimenting with deleveraging social in their media mix by expanding into CTV, programmatic audio, and podcasts as well. Over the past few years, there have been several innovations in tracking for these channels that make them more viable for non-awareness campaigns as well, especially during high-visibility campaigns. When buying programmatically through a DSP, you can avoid the high minimums that often come with running on these channels.

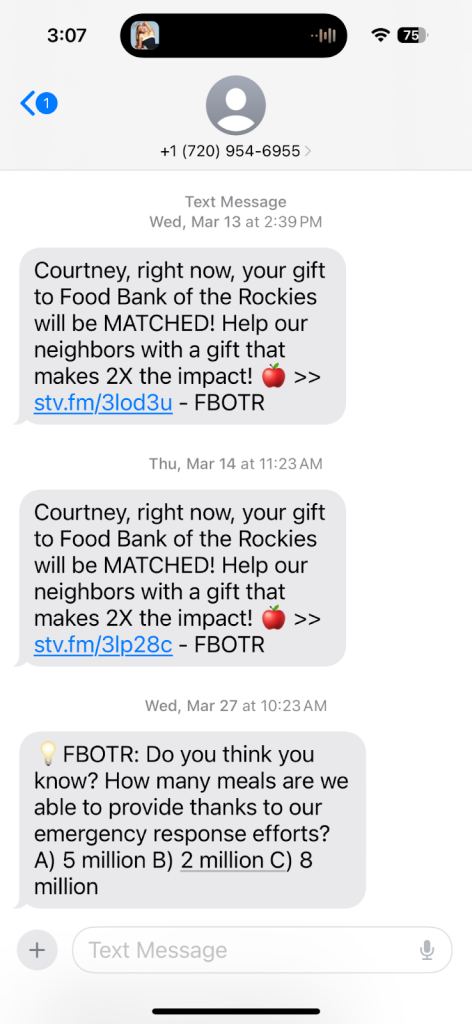

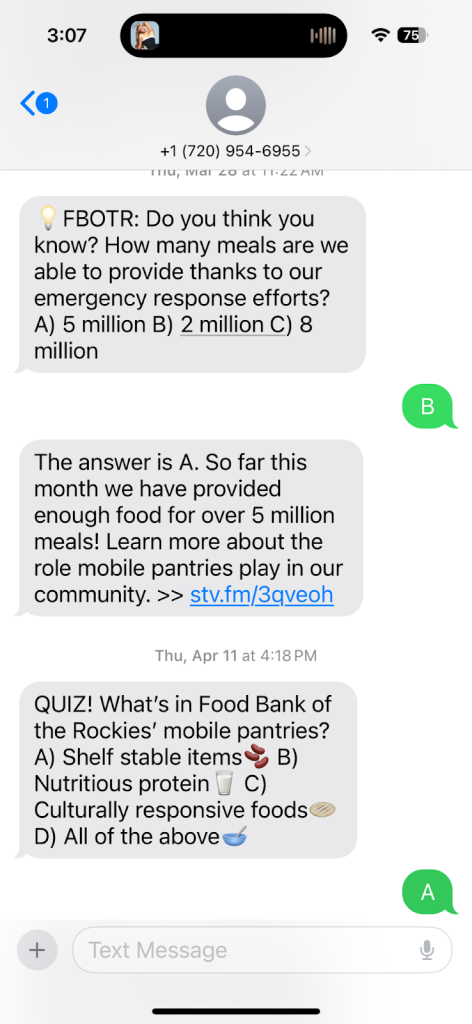

Another channel ripe with possibility? Text messaging! Not many food banks are taking advantage of this tool yet so we didn’t have enough data to share on this sector. But overall benchmarks shows that organizations were raising on average $92 per 1,000 mobile messages sent, more efficient than the $76 average for email. Mobile messaging is a great way to reach supporters, not just for fundraising but for events, action alerts, and other engagements. We see a lot of room for growth in this channel for the food bank sector.

Lean into tactics that are working, and create fundraising moments outside of End of Year.

As always, highlight Need, Impact, Urgency, Relevance, and Authenticity to develop ethical and effective creative. (Check out M+R’s guide on this for more!)

Food banks are full of natural relevance and authenticity as hubs in the community providing a much needed service to neighbors — creative with varying community points of view can help showcase this. Or try focusing on the real impact of the dollars donors provide: How many meals, how many people are getting support? What are the intangible benefits your work makes possible?

Tactics like matches and deadlines, especially when shown in eye-catching graphics can drive up urgency and demonstrate need at the same time.

Does the food bank need new equipment? Most do! Try an equipment campaign to get your community involved and excited about providing something specific to the food bank.

The food banks we work with have seen great success building momentum around an equipment campaign. The Community Food Bank of New Jersey, for example, has run successful campaigns for a new forklift and a new oven in previous years. Just recently they launched a campaign for a new food storage truck — the ask was so compelling that it landed on the local news!

Thank you to all the food banks who participated in this year’s Benchmarks! You can see the full list of participants here. Want to see your org’s name on that list next year? Be the first to know when our registration form is ready by signing up here!